New Recording Fees for the State of Colorado

by April Kovari, Heritage Title Company

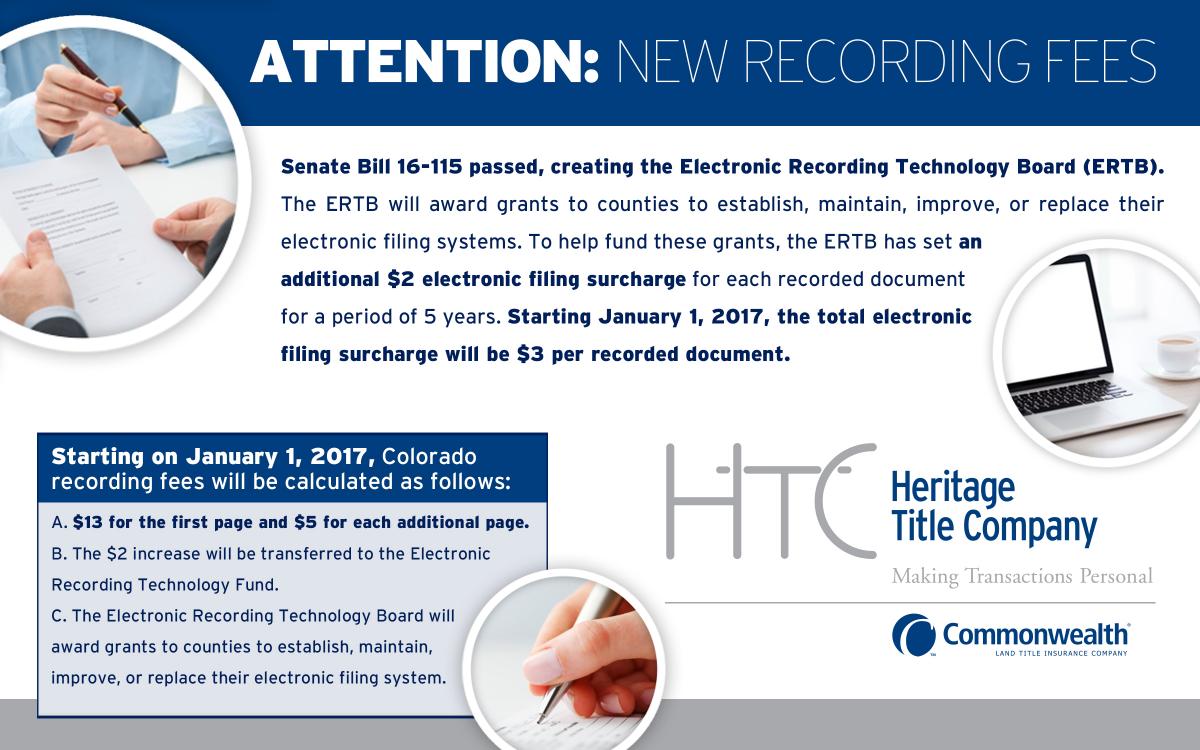

Effective January 1 2017, the State of Colorado will have new recording fees. With the passing of SB16-115, the Electronic Recording Technology Board (ERTB) was created. The board will consist of the Secretary of State, or his or her designee, and eight other members appointed. One member from the Real Estate section of the Colorado Bar Association, one member from the title industry, one member from the mortgage lending industry, five members who are current clerk and recorders.

The core goal of the initiative is to develop and modernize electronic filing systems in the state. They want to assure the security, accuracy and preservation of public records. Also, to maintain the privacy of personal identifying information and public access along with assuring that the sequence in which the documents are received by the clerk and recorder for filing is accurately reflected, regardless of whether documents are received electronically or by other means. Having the ability to provide online public access to records and to assure that the electronic filing systems used in different counties are similar.

The new Colorado recording fees will be calculated as follows:

- $13.00 for the first page and $5.00 for each additional page.

- For every filing surcharge collected, a county will retain $1.00 and transfer $2.00 to the Electronic Recording Technology Fund.

The Electronic Recording Technology Fund will award grants to counties to establish, maintain, improve or replace their electronic filing systems. They do plan to give priority to rural counties and to counties that do not have sufficient revenue from the surcharge proceeds that are retained.

With these changes it would be good to look at your current systems and update anything that is automatically calculating recording fees for buyer/seller estimates and net sheets.

Heritage Title Company is the proud Exclusive Annual Sponsorship Partner of the Denver Metro Real Estate Market Trends Report.

Learn more about our partner here →